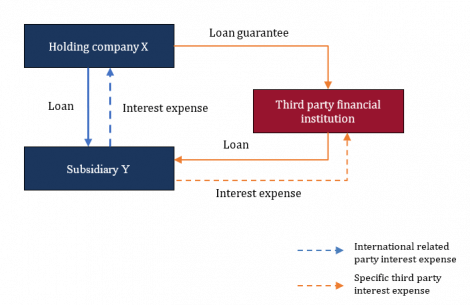

Holds a 35 stake in ABC Sdn Bhd and also owns 65 equity capital in XYZ Co. Will be subjected to interest restriction under Section 140C of the Act.

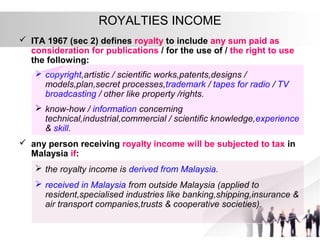

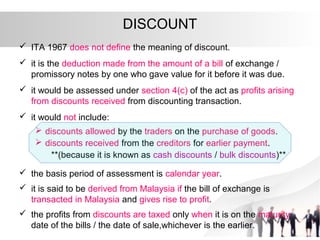

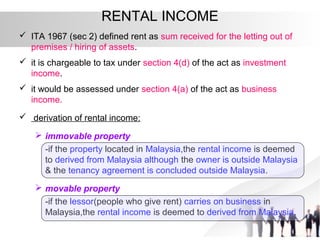

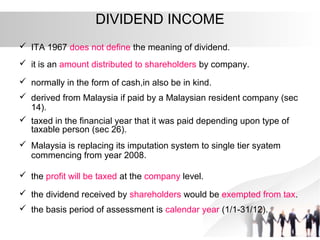

Taxation Principles Dividend Interest Rental Royalty And Other So

Any person not in possession of a Passport or Travel Document which is recognised by the Malaysian Government must obtain a Document in lieu of Passport.

. Western Regional Office Tel. Subsequently on 5 July 2019 the Inland Revenue Board of Malaysia IRBM published the guidelines for restriction on deductibility of interest against business income ie. There is also no restriction for non-residents to transfer abroad in foreign currency all profits returns and divestment proceeds from their investments in Malaysia.

Information on commodity classifications advisory opinions and export licenses can be obtained through the BIS website at wwwbisdocgov or by contacting the Office of Exporter Services at the following numbers. Malaysias Department of Insolvency MDI is the lead agency implementing the Insolvency Act of 1967 previously known as the Bankruptcy Act of 1967. Read the Department of States COVID-19 page before planning any international travel and read the Embassy COVID-19.

22011 Date of Issue. See EY Global Tax Alert Malaysia releases 2019 Budget dated 4 December 2018 and EY Global Tax Alert Malaysia enacts 2019 Budget proposals dated 3 January 2019. Interest restriction under subsection 332 of the ITA 3 - 7 7.

Possess a Passport or Travel Document. Read the country information page for additional information on travel to Malaysia. Includes license requirements for key professional services that are open to US.

Malaysia - Level 1. Every person entering Malaysia must possess a valid national Passport or internationally recognised Travel Document valid for travelling to Malaysia. Since 2009 Malaysia has liberalized 45 services sub-sectors.

Related provisions 1 4. Owns 25 shares of ABC Sdn Bhd owns 25 shares of ABC Sdn Bhd ii. The discussion below draws from various sources section 140C Rules vide PU order 1752019 IRB guidelines dated 5 July 2019 and FAQ.

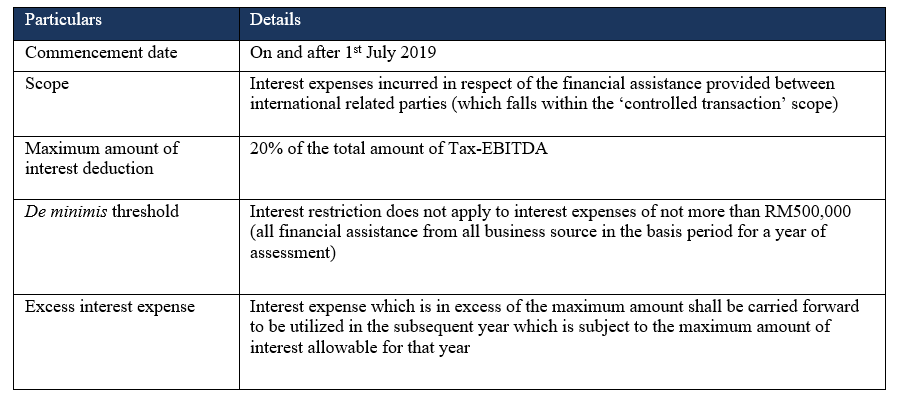

This provision known as earnings stripping rules ESRs in tax parlance was introduced with effect from 1 January 2019 in the form of section 140C. The provisions relating to the tax treatment of interest expense are. 27 July 2019.

Bank Negara Malaysia BNM continues to maintain a liberal foreign exchange policy FEP which is part of its broad prudential toolkits to maintain monetary and financial stability. Tax treatment of interest expense 1 - 3 6. Any payment of interest by ABC Sdn Bhd to ABC Co.

However for title with restriction in interest or caveat prior consent from the interested parties must be obtained first. Terms Condition TC FAQS Contact Us FAQS Contact Us. S33 1 general deductibility of expenses.

Gains or profits in lieu of interest 1 3. Although Section 140C of the ITA took effect from 1 January 2019 its implementation however requires certain rules to be prescribed by the Minister of Finance and in this regard the Income Tax Restriction on Deductibility of Interest Rules 2019 PU. Read the entire Travel Advisory.

Transfer of land is a process to change the name of registered proprietor in the title. If you decide to travel to Malaysia. Coping with the new Earning Stripping Rules.

TO WHOM THE LAND CAN BE TRANSFERRED. In Malaysia moneylending an activity of lending money with interest with or without security by a licensed moneylender to a borrower as defined by the Moneylenders Act 1951 are often confused with loan sharking. Foreign Investment Committee FIC guidelines prior to June 30 2009 states that any acquisition of property by foreign interest requires FIC approvals.

Visit the CDC page for the latest Travel Health Information related to your travel. This Corporate Interest Restriction only applies to individual companies or groups of companies that will deduct over 2 million in a 12-month period. Recently the Inland Revenue Board of Malaysia IRBM issued the Restriction on Deductibility of Interest Rules ESR which are intended to prevent base erosion through the use of excessive interest expense or any payments which are economically equivalent to interest via controlled financial assistance.

Corporate income tax CITA is expected to increase by 13 to RM7018bil from RM7053bil. The services sector has been a driver of Malaysias economic and job growth in recent years. The earnings stripping.

The Centers for Disease Control and Prevention CDC has. Income Tax Restriction on Deductibility of Interest Rules 2019 PUA. Has ordered ABC Sdn Bhd to.

S33 4 and 5 interest deductible when due to be paid and relevant compliance requirement. BNM is committed in ensuring FEP continues to support the competitiveness of the Malaysian economy by facilitating a more conducive environment for. S33 1 a specific deductibility of interest expense.

Contrary to money lending loan sharking as defined by a simple Wikipedia search is an illegal activity of offering loans at. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. Section 140C of the Income Tax Act 1967 ITA.

7 February 2011 CONTENTS Page 1. In Malaysia in computing the adjusted income for a person in a basis period of a year of assessment YA interest expenses are generally deductible against the gross income of a person provided certain conditions are metThe Income Tax Restriction on Deductibility of Interest Rules 2019 Rules has recently been gazetted and came into. On October 6 2017 the Bankruptcy Bill 2016 came into force changing the name of the previous Act and amending certain terms and conditions.

The eastern area of Sabah State due to kidnapping. Copyrights 2022 All Rights Reserved by Attorney Generals Chambers of Malaysia. Malaysia - Licensing Requirements for Professional Services.

And there are parts which have been customised to ensure adherence to the Act and Inland Revenue Board of Malaysias IRBM procedures as well as domestic circumstances. INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No. The transfer of land can be done only for the title that has no restriction in interest or caveat.

Some areas have increased risk. Section 140C Restriction on deductibility of interest. Exercise normal precautions in Malaysia.

The Centers for Disease Control and Prevention CDC has determined Malaysia has a high level of COVID-19.

11 Things That Are Illegal In Malaysia

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

In The Matter Of Interest Crowe Malaysia Plt

In The Matter Of Interest Crowe Malaysia Plt

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Drone Laws In Malaysia Updated March 10 2022

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Pdf Procedural Laws Governing Event Of Default In Islamic Financing In Malaysia Issues And Challenges

Taxation Principles Dividend Interest Rental Royalty And Other So

Boccia 3580 02 Watch 3580 02 Gents Watches Dating Women Watches For Men

Vietnam Saigon Vietnam Travel South Vietnam Vietnam

Crowe Chat Tax Vol 1 2022 Crowe Malaysia Plt

Pdf A Comparative Analysis On Takaful Acts Between Malaysia And Indonesia

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Taxation Principles Dividend Interest Rental Royalty And Other So